Tesla Stock Tumbles After Earnings Miss, Dim 2024 Outlook

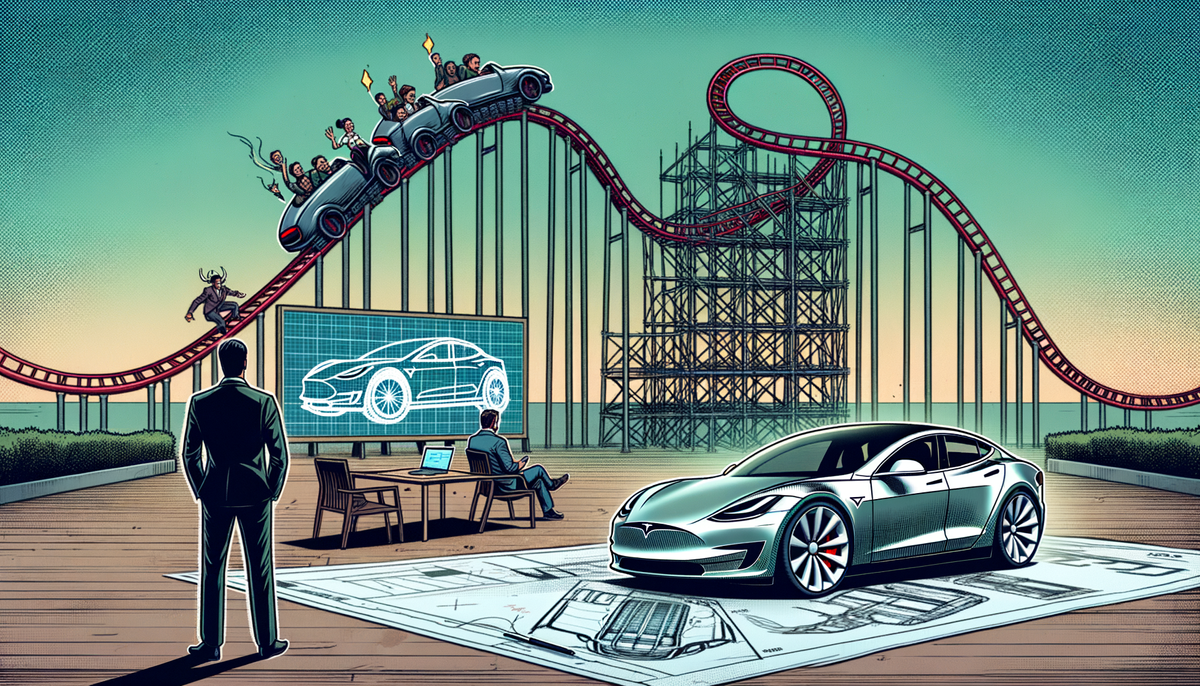

Tesla's stock experienced a significant decline after the company's fourth-quarter earnings report missed analysts' estimates and suggested a more cautious full-year production outlook. The electric vehicle (EV) manufacturer reported quarterly revenue of $25.17 billion, marking a modest 3% increase from the same period the previous year, and adjusted net income of $2.48 billion. Despite this, Tesla's shares saw a decrease of over 10% as the company projected that its vehicle volume growth rate in 2024 could be substantially lower than the growth achieved in 2023.

Additionally, Tesla announced plans to commence production of a new mass-market electric vehicle, known as "Redwood," in the middle of 2025. CEO Elon Musk highlighted progress on a next-generation manufacturing platform but also indicated a focus on development efforts for future products, which may affect near-term production volumes.

Tesla's market performance has been affected by several factors, including competition from other EV makers like Hyundai and Kia, import price dynamics in China and Europe, and investor concerns over the company's strategic direction. Some Wall Street analysts have reduced their price targets for Tesla's stock, pointing to a "cloudy path ahead" and potential downside risks in the EV market. However, there remains a mix of views among analysts, with some maintaining a long-term growth perspective for the company, while others have expressed a more cautious or negative outlook.