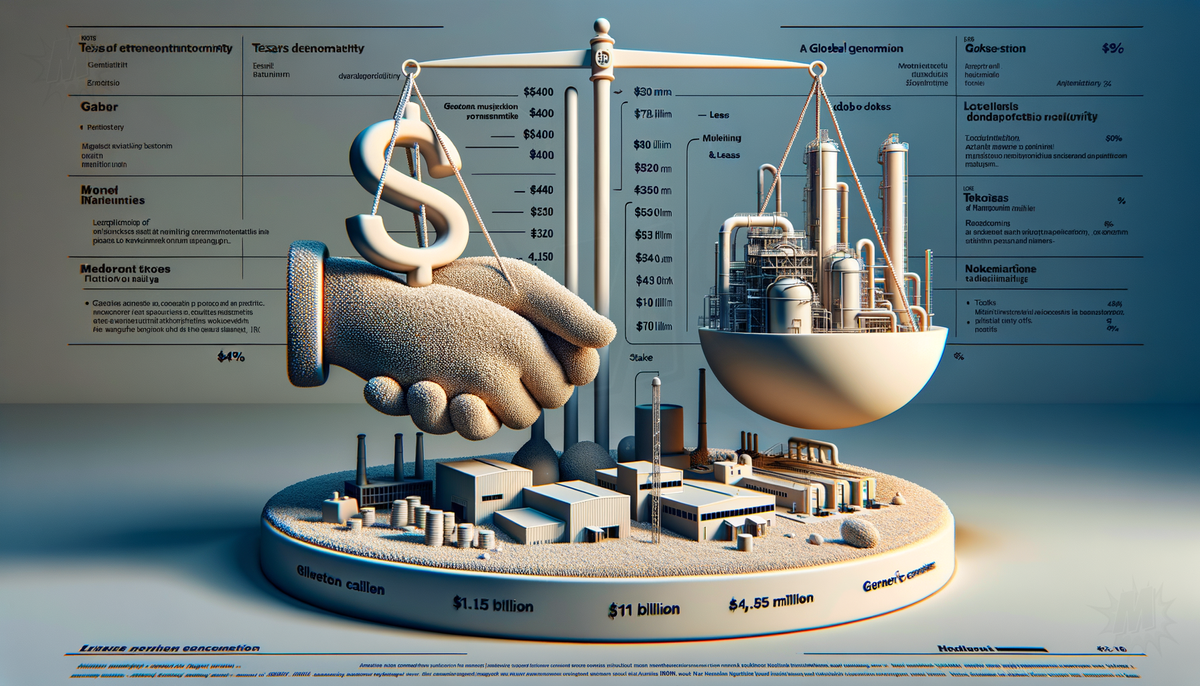

Methanex Acquires OCI's Methanol Business for $2.05 Billion

OCI Global has entered into a binding equity purchase agreement to sell its Global Methanol Business to Methanex Corporation for $2.05 billion. The transaction will be settled through a combination of $1.15 billion in cash, the issuance of 9.9 million shares of Methanex valued at approximately $450 million, and the assumption of about $450 million in debt and leases. Upon completion, OCI will hold approximately a 13% stake in Methanex, making it the second-largest shareholder in the company.

The acquisition includes OCI's methanol production facilities in Beaumont, Texas, and a low-carbon methanol production and marketing business in the Netherlands. Methanex expects the acquisition to enhance its free cash flow per share and plans to integrate OCI’s operational practices into its global management processes. The deal, which is part of OCI's broader divestiture strategy, is anticipated to close in the first half of 2025, pending regulatory and shareholder approvals. The proceeds from this transaction will be considered alongside funds from OCI’s previously announced divestitures in IFCo, Fertiglobe, and OCI Clean Ammonia.