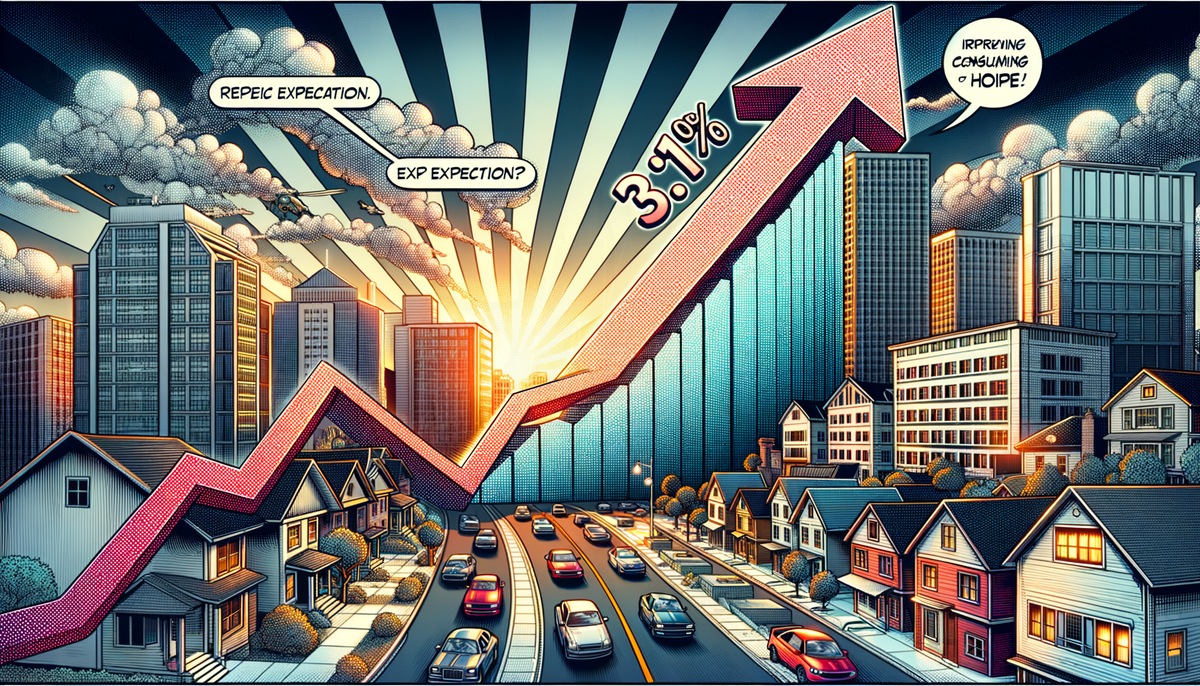

January Inflation Surges, Pressuring Fed's Rate Strategy

The Consumer Price Index (CPI), a key gauge of inflation, indicated a 3.1% rise in consumer prices in the year through January, surpassing the 2.9% increase economists had anticipated. This figure marks a slight deceleration from the 3.4% annual rate recorded in December. Housing and food prices were significant contributors to the higher inflation rate. On a month-to-month basis, the CPI climbed by 0.3% in January after a 0.2% rise in December.

Core CPI, which strips out the often-volatile costs of food and energy, showed a 3.9% increase over the same period a year earlier, compared to a 3.3% rise prior. The data presented by the Bureau of Labor Statistics suggest that inflationary pressures have not eased as quickly as hoped, presenting a challenge for the Federal Reserve as it considers the timing for reducing interest rates. Despite the persistent inflation, consumer sentiment has shown signs of improvement, influenced by better outlooks for inflation and income growth.

The Federal Reserve, under the leadership of Chairman Jerome Powell, has expressed the need for more conclusive signs of cooling inflation before proceeding with rate cuts. The majority of economists are now anticipating the first rate cut to potentially occur in May, with less than 20% predicting a cut at the Fed's March meeting. The central bank's upcoming decision will take into account the latest inflationary trends as it seeks to navigate the complex economic landscape.